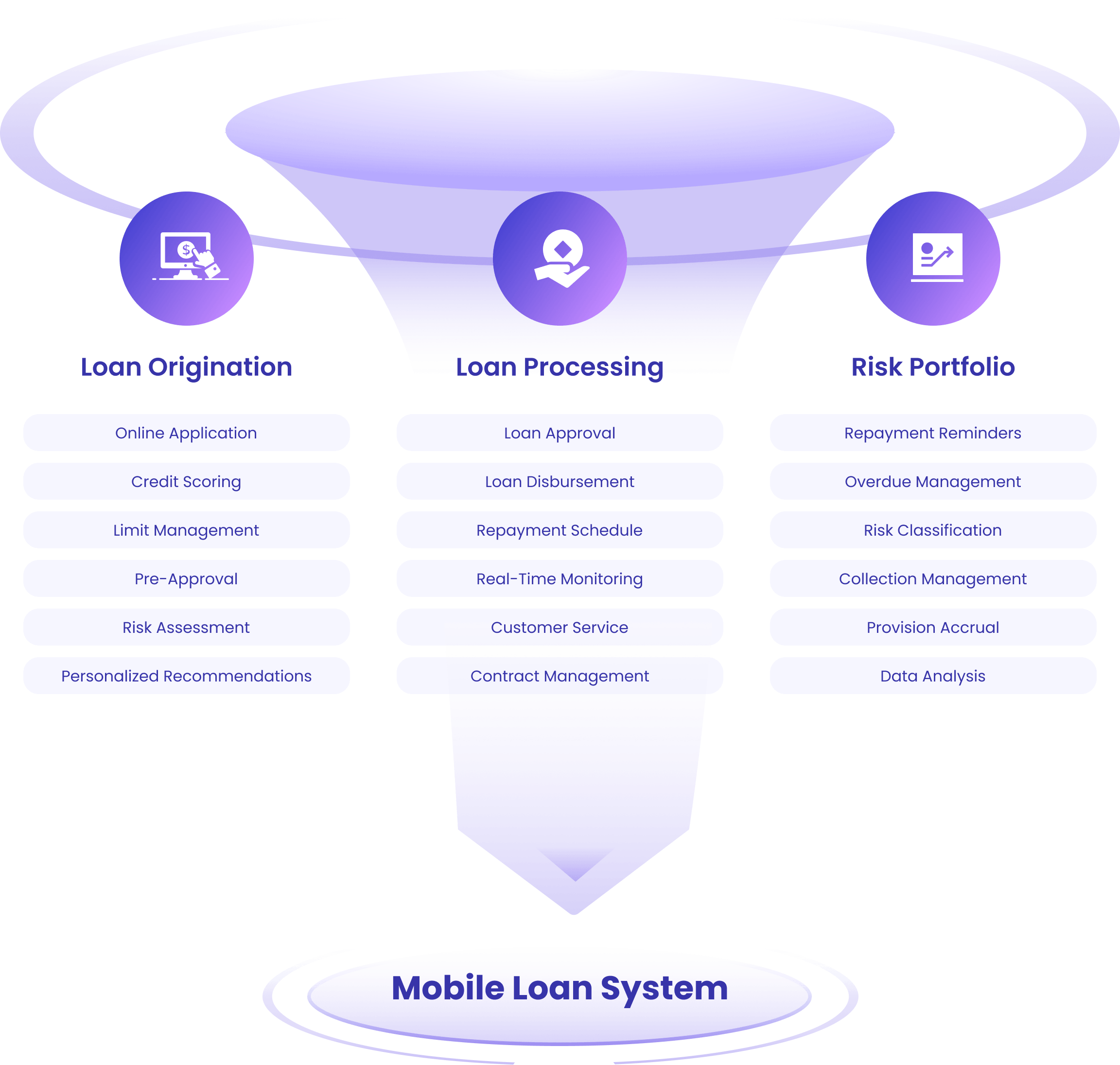

MuRong Mobile Loan System is a highly automated online platform that utilizes advanced data analysis, automated credit engine and user-friendly technology to provide 0-wait, and flexible lending services, such as Term Loan, Overdraft and BNPL. MuRong Mobile Loan provides end-to-end loan management throughout the loan origination, loan processing, and risk portfolio processes, leverages big data and AI technology to offer precise credit assessments, efficient loan processing, and intelligent risk monitoring and collection management.

Our

Product features

One-stop Mobile Loan Solution

We covers the full loan lifecycle from disbursements to pay-offs. Users can enjoy one-stop lending services on this software, including but not limited to loan application, approval, disbursement, repayment, customer service, etc.

Configurable Loan Product Model

Create new loan products in a snap. Configure loan terms, set amount limits, product pricing, interest rates, repayment methods, risk classifications, and portfolio with ease. Make customization a breeze and optimize the process for a seamless customer journey.

Digital Onboarding

Implement a seamless, end-to-end digital process with biometric verification and tiered KYC.

Diversified Repayment

Rich and diverse repayment methods give you more choices:

Reducing balance-Equal interest, reducing balance-Reducing interest, straight line, balloon payments,

bullet payments,

regular interest repayment and P+I repayment at maturity.

Automated Credit Disbursement

Supports automated credit scoring, preapprovals, limit allocation, disbursements and repayments. direct debit, and integration with payment providers.

Easy Integrations

We can deliver our standardization loan capabilities and integrate it with your business environment if you have your own ecosystem. Include loan account management, pre loan, in loan, and post loan lifecycle management.

Mobile Loan Meet AI Power

Murong's AI technology combines to assess loan scoring, loan portfolios, automate debt collection, and gain invaluable data-driven insights.

Our

Product

Benefits

Launch in Short Time

Minimizes the need for third-party integrations, allowing for rapid deployment and faster business growth. The out-of-the-box SaaS platform provides a simple, cost-effective way to launch your lending business.

Calculator Help to Attract more Customers

Delivers a convenient, customer-friendly experience. Your borrowers can easily apply for loans online, with a intuitive loan calculator that transparently displays your product details - loan terms, repayment period, fees, and more. This transparency helps attract and convert more potential customers.

Boost Business Operation Efficiency

With an all-in-one, scalable back-office system, your team can customize new loan products, manage loans, oversee borrowers, keep track of payment schedules, accruals and write-offs seamlessly. Maximize staff efficiency, reduce costs, and gain operational flexibility.

Flexible Level of Automation

Offers flexible product configurations, enabling the rapid creation of new loan offerings. Automated credit scoring, pre-approvals, and loan disbursement streamline the customer experience, while also reducing operational overhead for your team. With robust security and smooth business operations, you can deliver a compelling customer proposition that drives strong financial performance.

AI Makes Your Collection Easier

The use of AI intelligent voice technology not only saves you labor costs, but also makes debt collection simpler, more efficient, and intelligent.